6 Ways to Spend Your Stimulus Responsibly

Have you received your COVID-19 stimulus payment or are you expecting it soon? Have you started thinking about how you would spend it? It’s tempting to think about all of the ways you could spend an extra $1,200 or $2,400 – depending your filing status and the number of dependents you claim. Before you get […]

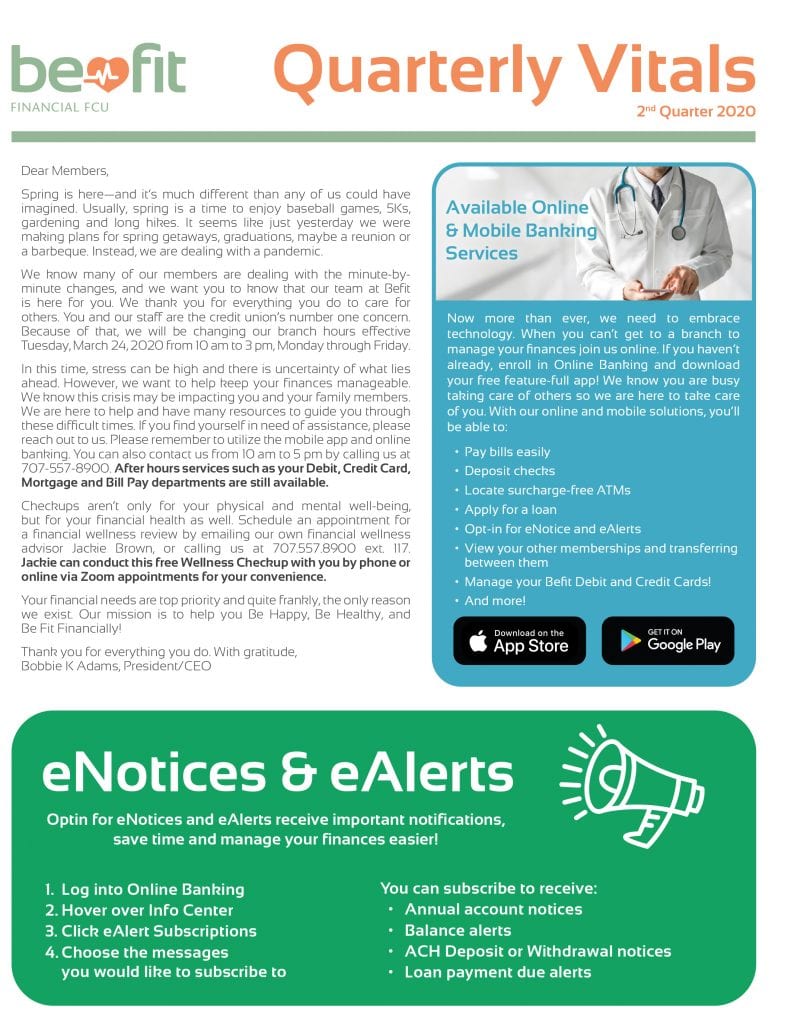

2nd Quarter 2020 PDF